Book a free 1:1 session to find your ideal course

Skillcubator Training and Placement Institute has designed the FinTech Business Analysis Training and Placement Program to prepare aspiring professionals for success in this dynamic domain. This comprehensive, hands-on program empowers learners with domain knowledge, analytical methodologies, and the latest tools required to analyze, document, and support FinTech initiatives across diverse business areas like payments, lending, wealth management, insurance, and regulatory compliance.

The program blends business analysis tools and techniques, fintech domain, real-world use cases, agile project practices, and capstone projects to ensure practical readiness. Whether you’re transitioning from a non-IT role, starting your career, or upskilling as a practicing business analyst, this training serves as a launchpad into high-demand ‘Fintech Business Analyst’ role with guided placement support.

This training program is designed for professionals who want to play a pivotal role in Fintech projects by bridging business needs with Fintech solutions. You should consider this course if you are:

- Aspiring Business Analysts seeking to specialize in Fintech domain.

- Existing Business Analysts who want to expand their expertise into Fintech domain.

- IT Professionals, Project Managers, or QA Analysts working on or planning to work on Fintech initiatives.

- Individuals aiming to switch their careers into the high-growth field of Fintech domain.

- Individuals with background in Business, Finance, Computer Science seeking industry-relevant, job-ready training.

- Mid-career professionals interested in upskilling or reskilling into high-growth digital finance domain.

Whether you’re starting fresh or pivoting into FinTech, this program provides the structure, knowledge, and career support needed to make a successful transition.

To equip learners with core business analysis skills applied in the financial technology (FinTech) domain, covering digital banking, payments, blockchain, regulatory compliance, and system integration.

This program prepares candidates for roles such as FinTech Business Analyst, Product Analyst, and Digital Transformation Analyst in the BFSI sector.

This course provides hands-on exposure and real-world case studies to help individuals become job-ready professionals in one of the most in-demand areas of IT and business today.

Fundamentals of Fintech and Business Analysis

- 1.1 What is FinTech? Overview and Trends.

- 1.2 FinTech Ecosystem: Banks, Startups, Regulators, Consumers.

- 1.3 What is Business Analysis?

- 1.4 Core Business Analyst Responsibilities in BFSI.

- 1.5 Business Analyst responsibilities in fintech.

- 1.6 Introduction to Fintech: Digital Banking, Payments, Lending, Blockchain, Insurtech, Regtech etc.

- 1.7 Fintech Market Trends: Open Banking, Embedded Finance, AI-Driven Solutions.

Core Business Analysis Skills

- 2.1 Stakeholder Analysis.

- 2.2 Creating RACI Matrix.

- 2.3 Requirements Elicitation Techniques.

- 2.4 Software Development Lifecycle

- 2.5 Waterfall Methodology and Agile (Scrum) Framework.

- 2.6 Documenting requirements: Business Requirement Document (BRD), Functional Requirement Document (FRD).

- 2.7 Fintech-specific requirements: Security, scalability, and compliance.

Process Modeling and Fintech Systems

- 3.1 Overview of fintech systems: Core banking, payment gateways, lending platforms, wealthtech.

- 3.2 Business Process modeling techniques: Standard Notations and BPMN 2.0.

- 3.3 Creating Unified Modeling Language (UML) diagrams such as Use Case, Activity Diagram, State-Chart (Machine) and Sequence Diagram.

- 3.4 Creating System Context Diagram (Data Flow Diagram).

- 3.5 API integration in fintech: REST APIs, open banking standards (e.g., PSD2).

FinTech Domains and Processes

- 4.1 Digital Banking: Internet & Mobile Banking Workflows.

- 4.2 Lending Platforms: Loan Origination and Credit Scoring Systems.

- 4.3 Payments & Wallets: UPI, ACH, SWIFT, Card Processing.

- 4.4 WealthTech: Robo-Advisors, Mutual Funds, Trading Platforms.

- 4.5 Insurtech: Claims Processing, Policy Management.

- 4.6 RegTech: KYC, AML, Fraud Detection.

Regulatory Compliance and Risk Management

- 5.1 Compliance Workflow Mapping.

- 5.2 Key regulations: GDPR, PCI-DSS, AML, KYC, CCPA.

- 5.3 Risk management: Operational, financial, cybersecurity, and reputational risks.

- 5.4 Compliance documentation: Audit trails, regulatory reporting (e.g., Basel III, Dodd-Frank), and data privacy policies.

- 5.5 Understanding Open Banking and PSD2 Regulations.

Agile Methodologies for Fintech Projects

- 6.1 Agile frameworks: Scrum, Kanban, hybrid approaches.

- 6.2 Writing user stories, acceptance criteria, and prioritizing backlogs.

- 6.3 Agile ceremonies: Sprint planning, daily standups, retrospectives.

- 6.4 Fintech Agile challenges: Balancing speed, quality, and compliance.

Data Analytics in FinTech

- 7.1 Data-Driven Decision Making.

- 7.2 KPIs for FinTech Products.

- 7.3 Fintech data sources: Transaction logs, customer profiles, market data.

- 7.4 Data analysis tools: SQL for querying, PowerBI or Tableau for data visualization.

- 7.5 Key fintech metrics: Churn rate, customer lifetime value, fraud detection rates.

UX/UI Design for Fintech Applications

- 8.1 UX principles: Usability, accessibility, and trust in fintech.

- 8.2 Prototyping tools: Figma, Adobe XD for wireframing and mockups.

- 8.3 Customer journey mapping: Onboarding, transactions, support.

Emerging Technologies in Fintech

- 9.1 Blockchain: Smart contracts, decentralized finance (DeFi), tokenization.

- 9.2 AI and machine learning: Credit scoring, fraud detection, chatbots.

- 9.3 Cloud computing: AWS, Azure for scalable fintech infrastructure.

Career Preparation and Placement Support

- 10.1 Fintech career paths: Business Analyst, Product Owner, Compliance Analyst.

- 10.2 Resume building: Tailoring for fintech roles.

- 10.3 Interview preparation: Behavioral and technical questions (200+ fintech-specific questions provided).

- 10.4 Networking: Optimizing LinkedIn and connecting with fintech recruiters.

- 10.5 Placement support: Job application strategies and employer introductions.

- Training Program as per Latest Industry Demand.

- IIBA Endorsed Education Provider.

- Access to Learning Management System (LMS).

- Free PSM-I and PSPO-I training included in the package.

- 40 PDUs/CDUs.

- IIBA Certified Instructors with 20 plus years of experience.

- Plenty of case studies, In-Class exercises, quizzes, and take-home assignments.

- 15 Plus Industry-Standard tools

- Personalized Resume, LinkedIn Profile makeover and Cover Letter.

- Course aligned to IIBA’s BABOK 3.0 and PMI’s body of knowledge.

- Comprehensive Capstone project.

- Experiential learning through case studies.

- Microsoft Office (Word, Excel, PowerPoint), Google Docs, Google Sheets.

- Microsoft Visio, Gliffy, Lucidchart.

- Bizagi, Camunda, Bonita, Signavio, Draw.io.

- Power Bi, Tableau.

- Postman.

- Figma, Balsamiq, Adobe XD.

- Jira.

- Confluence.

- Miro.

- AWS (Amazon Web Services).

- Kanbantool, backlog.com or similar Kanban tool.

This course will be taught by certified professionals in business analysis and Fintech domain with 15 plus years of corporate experience.

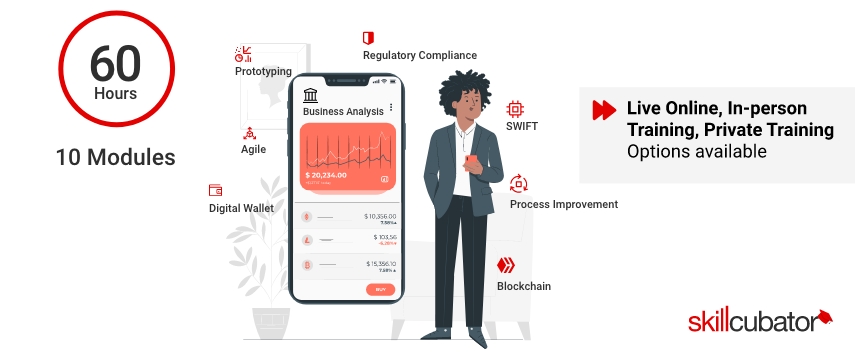

The program is appx. 12-week (60-hour) training program designed to equip participants with the skills to become business analysts in the fintech industry. It covers requirements elicitation, process modeling, regulatory compliance, agile methodologies, data analytics, UX/UI design, and emerging technologies like blockchain and AI. The program includes hands-on projects, a capstone project, and comprehensive placement support to secure fintech business analyst role.

This program is ideal for:

- Aspiring business analysts looking to specialize in fintech.

- Recent graduates in business, finance, or IT seeking entry-level roles.

- Finance professionals transitioning to technology-driven roles.

- IT professionals aiming to pivot into fintech business analysis.

No. A technical background is not mandatory. This training will cover all aspects of business analysis and Fintech domain and make you ready to work as a Business Analyst in Fintech domain.

Truly speaking there are no absolute prerequisites to become a successful Fintech Business Analyst. But it would be nice to have the following to become a successful Fintech business analyst:

- Basic computing skills (MS Office like Word, Excel and PowerPoint).

- Decent communication skills (verbal and writing in English).

- Comfortable talking to people.

- Basic knowledge of finance.

If you have these things, we guarantee to transform you into a Fintech business analyst.

No, the program is designed for both beginners and professionals with some experience. It starts with foundational concepts and progresses to advanced fintech topics, ensuring accessibility for all learners.

The curriculum is aligned with the International Institute of Business Analysis (IIBA) BABOK v3.0 framework, ensuring relevance to global business analysis standards. It also incorporates fintech-specific regulations and best practices, such as GDPR, PCI-DSS, and open banking standards.

Fintech Business Analysis Scope

The scope of a FinTech Business Analyst in the USA is strong and growing rapidly, driven by the digital transformation of financial services, increasing regulatory requirements, and the expansion of new-age financial technologies like blockchain, AI, and open banking.

Market Demand

Financial institutions, neobanks, and fintech startups are actively hiring business analysts to bridge the gap between business needs and technology teams. BAs are key in modernizing legacy systems, integrating APIs, and ensuring compliance with U.S. financial regulations (e.g., CFPB, SEC, OCC).

Job Outlook

Fintech professionals are in great demand in the following areas:

- Banking (Core Banking, Lending, Payments).

- Investment Platforms (e.g., Robinhood, Fidelity).

- InsurTech.

- RegTech.

- WealthTech.

- Cryptocurrency & Blockchain.

- Buy Now Pay Later (BNPL) platforms

Salary Range (USA)

Fintech Business Analyst usually draw salary in the following range:

- Entry-level: $75,000 – $90,000

- Mid-level: $95,000 – $120,000

- Senior/Lead BAs: $130,000 – $150,000+

Interesting thing is that often times FinTech companies offer stock options and bonuses to their employees, which make it more lucrative and rewarding career option.

The following career paths are available after successful completion of the training program:

- Fintech Business Analyst

- Product Owner

- Compliance Analyst

- Requirements Analyst

- Agile Project Coordinator

These roles are in demand at fintech startups, banks, payment processors, and tech companies.

There are plenty of career opportunities such as IT Project Manager, Program Manager, Scrum Master, Product Manager, Fintech SME (Subject Matter Expert) and any suitable role in PMO (Project Management Office). Additionally, there are alternative career paths such as Data Analyst, Regulatory Analyst, and Digital Transformation Consultant.

The FinTech Business Analyst role offers a dynamic, high-growth career with strong compensation, opportunities across industries, and relevance in both startups and enterprise firms. The role will continue to evolve with advances in AI, blockchain, and real-time payments.

Please visit the course page to review the list of topics covered in this training.

Yes. The program includes guided labs, real-time case studies, take-home assignments, in-class exercises, quizzes etc.

The capstone project is a hands-on, real-world simulation where participants design a fintech product (e.g., digital wallet, lending platform, or payment gateway). It involves creating deliverables such as a Business Requirements Document (BRD), business process flows, prototypes, compliance plans, and analytics dashboards. The project spans 8-10 weeks and culminates in a presentation to instructors and peers.

Duration: Typically, 10-12 weeks.

Format: Live instructor-led sessions (online), self-paced learning modules, and assignments.

Schedule: Evening and weekend batches available.

Yes. Skillcubator offers comprehensive placement support, including:

- Professional resume preparation

- Cover Letters.

- Unlimited mock interviews.

- LinkedIn optimization.

- Resume marketing through our in-house recruiters and partner network.

- Background check support.

- On-the-project mentoring, coaching and guidance.

The program includes comprehensive placement support, such as:

- Resume and LinkedIn Optimization: One-on-one sessions to tailor your resume and LinkedIn profile for fintech roles.

- Interview Preparation: Access to a 200+ question bank of fintech-specific behavioral and technical questions, plus three mock interviews.

- Job Placement Assistance: Connections to Skillcubator’s network of fintech employers, including startups, banks, and tech firms.

- Post-Placement Support: Three months of free mentoring after securing a job (additional mentoring at $50/hour).

- Networking: Invitations to Skillcubator’s fintech webinars and industry events.

Yes. Skillcubator Training Institute is a ‘Premium-Level Endorsed Education Provider (EPP) from IIBA.org. After successfully completing the training program, participants will receive a ‘Certificate of Completion’ from Skillcubator with an IIBA seal on it, which can be shared on LinkedIn and included in resumes. Additionally, participants can claim 40 PDUs/CDUs towards any of the business analysis certifications offered by IIBA.

Please visit the course page to know more about the fee structure and enrollment options. Alternatively, you can contact Skillcubator directly through www.skillcubator.com for detailed pricing, enrollment assistance, and upcoming batch information.

Yes. Participants get 10% off if they enroll right after the webinar/demo session. Group discounts are also available for three or more participants enrolling together. Contact info@skillcubator.com for details.

Yes, Skillcubator offers a trial period for the first three sessions. If you choose to withdraw during this period, you are eligible for a full refund (in case you have made the payment), or discontinue the training without any future commitment, ensuring a risk-free start.

Please visit the course page to know more about the list of tools/software that are used for this training program.

View Software / Tools used for this training

No. There is no additional cost to install and use the tools/software that will be used for this training.

Not at all. There is no coding/programming skills required to become a successful Fintech Business Analyst.

During this training program, you will master business analysis techniques tailored to fintech. This includes:

- Requirements elicitation, analysis, documentation and managing solution requirements.

- Understand fintech regulations (GDPR, PCI-DSS, AML, KYC) and integrate compliance into projects.

- Apply Agile methodologies (Scrum, Kanban) to manage fintech projects.

- Design user-centric fintech solutions with a focus on UX/UI.

- Explore emerging technologies like blockchain and AI.

- Complete a capstone project simulating a fintech product launch.

- Be job-ready with tailored resume, interview, and placement support.- Hands-on Salesforce configuration.

- Tools like MS Visio, Jira, Confluence, Lucidchart, Balsamiq etc.

For more detailed course outline, please visit the course page to know more about the list of tools/software that are used for this training program.

Yes. All live sessions are recorded, posted on the Learning Management System (LMS), and shared with participants, allowing you to catch up at your convenience.